Trading on crypto exchanges can be safe and efficient with the right approach. First, choose a reputable exchange, like picking a trustworthy restaurant—no one wants food poisoning from bad reviews. Next, secure your assets with measures like two-factor authentication and cold storage, because who wants to wake up to an empty wallet? Understand trading fees and order types to navigate your investments smartly. Stay vigilant with ongoing risk management, and you’ll be well-equipped for the crypto ride ahead!

In an ever-evolving digital landscape, where cryptocurrencies are as common as coffee shops, traversing crypto exchanges can feel like wandering through a maze without a map. To steer through this labyrinth effectively, one must first choose a reputable exchange. This involves verifying regulatory compliance and licensing, much like checking the credentials of a new barista. With 425 million users actively participating in cryptocurrency transactions worldwide, finding the right exchange platform is crucial.

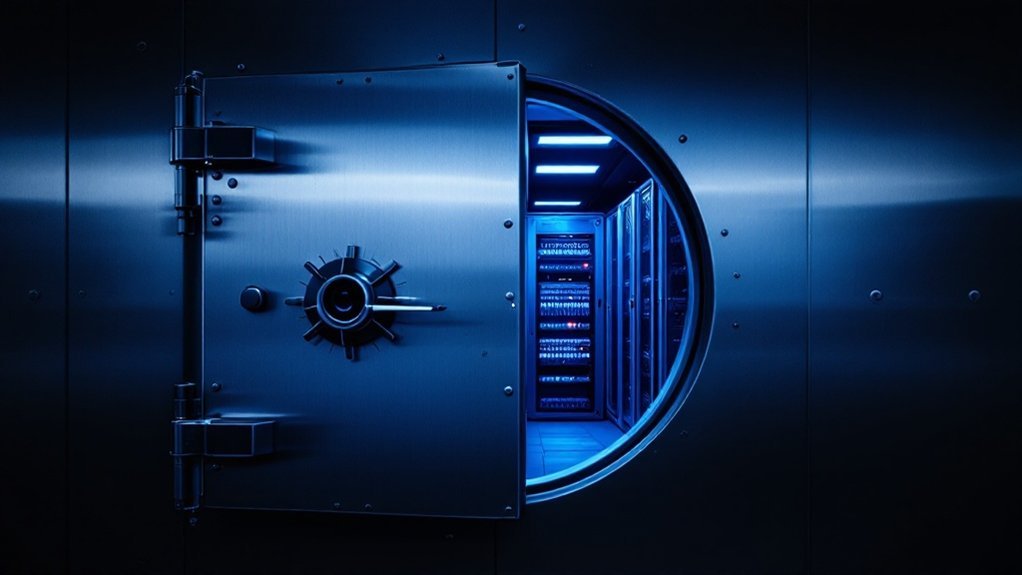

Security measures are paramount too; think of cold storage and insurance as the vaults that keep your precious assets safe. A quick Google search for the exchange’s history can reveal if they’ve encountered past hacks—because nobody wants to pour their life savings into a leaky boat. Additionally, strong security policies ensure the safety of funds and sensitive user data, creating a trustworthy environment for trading. With the cryptocurrency exchange sector expected to expand significantly, selecting a reliable platform is more crucial than ever to capitalize on the market growth.

Prioritize security like a vault for your assets; a quick search can uncover past breaches to avoid risky exchanges.

Once an exchange is selected, the next step is implementing strong account security. Enabling two-factor authentication (2FA) is like adding a second lock to your front door. Unique, complex passwords are necessary too; using “password123” is so 1999.

Storing large amounts of crypto on exchanges long-term is akin to leaving your bike outside a café overnight—risky and unwise. Regularly monitoring account activity can help spot suspicious transactions before they escalate.

Understanding trading fees is vital for anyone looking to make a profit. It’s like understanding the menu at a diner—nobody wants to order the lobster special only to find out they were charged extra for the butter. Comparing maker and taker fees, alongside deposit and withdrawal costs, guarantees that your trading expenses don’t sneak up on you like a surprise check at the end of a meal.

Finally, mastering order types and execution is essential. Knowing the difference between market, limit, and stop orders is like knowing when to hit the gas or brake while driving.

Utilizing advanced order types can manage risk, while proper position sizing helps avoid catastrophic losses—think of it as steering through traffic without causing a pile-up. With these strategies, traders can not only survive but thrive in the bustling world of crypto exchanges.

Frequently Asked Questions

What Are the Best Crypto Exchanges for Beginners?

When considering the best crypto exchanges for beginners, options like Coinbase and Gemini stand out.

Coinbase is like a friendly guide, offering an easy-to-navigate interface and helpful educational resources.

Meanwhile, Gemini shines with its focus on security and compliance, making users feel like they’ve locked their treasures in a digital fortress.

Kraken, Binance, and eToro are also great choices, each with unique features that cater to novice traders aiming to explore the crypto world safely.

How Do Transaction Fees Vary Across Different Exchanges?

Transaction fees can vary considerably across cryptocurrency exchanges, much like choosing between different coffee shops. Some exchanges, like Binance, offer a standard fee of 0.1%, while others, such as Coinbase Pro, charge 0.5% for smaller trades.

Higher trading volumes usually lead to lower fees, akin to bulk buying snacks for a party. Additionally, factors like payment methods and account verification can further influence these fees, making it essential to compare options before diving in.

Are There Any Tax Implications for Crypto Trading?

When it comes to crypto trading, the tax implications can feel like a puzzle with missing pieces. Each trade is like a mini tax event, whether selling for cash or swapping coins.

Short-term gains? Those get taxed like your regular paycheck. Long-term? They can be a bit kinder, depending on how long you hold.

Remember to track everything meticulously; it’s like keeping a diary, but for money. Miss a detail, and Uncle Sam might come knocking!

Can I Trade Crypto Using a Mobile App?

Absolutely, trading crypto through a mobile app is not just possible; it’s become the go-to method for many.

Imagine having the stock market in your pocket—minus the suit and tie! Most major exchanges offer user-friendly apps packed with features like real-time price alerts and charting tools.

However, security is key. Think of it like locking your front door; enabling two-factor authentication guarantees your funds stay safe while you’re on the move.

What Security Features Should I Look for in an Exchange?

When considering security features in an exchange, a few essentials stand out.

Two-Factor Authentication (2FA) adds an extra layer, like a bouncer at a club checking IDs.

Cold storage keeps most funds offline, protecting against online theft.

Withdrawal security measures, such as address whitelisting and time delays, act like a safety net.

Look for regular audits and insurance coverage, ensuring that even when things get dicey, your funds remain secure.