In a surprising twist worthy of a suspense thriller, two high-ranking Binance executives found themselves tangled in a web of regulatory challenges in Nigeria. Tigran Gambaryan and Nadeem Anjarwalla, while in Nigeria for discussions on regulatory oversight, were detained amid escalating tensions between Binance and Nigerian authorities. The allegations? Money laundering and tax evasion—terms that sound like they belong in a crime drama rather than a business meeting.

The backdrop to this incident was Nigeria’s severe economic crisis, rife with inflation and currency devaluation. Authorities accused Binance of damaging the national economy, a claim that had executives scrambling like characters in a heist film. When Nigerian officials demanded user data and the disabling of Binance’s peer-to-peer services, the company’s refusal ignited further conflict, raising eyebrows and questions about international privacy laws.

Adding a spicy twist, reports emerged of a $150 million bribe request from shadowy figures in the government, turning the whole affair into a high-stakes poker game.

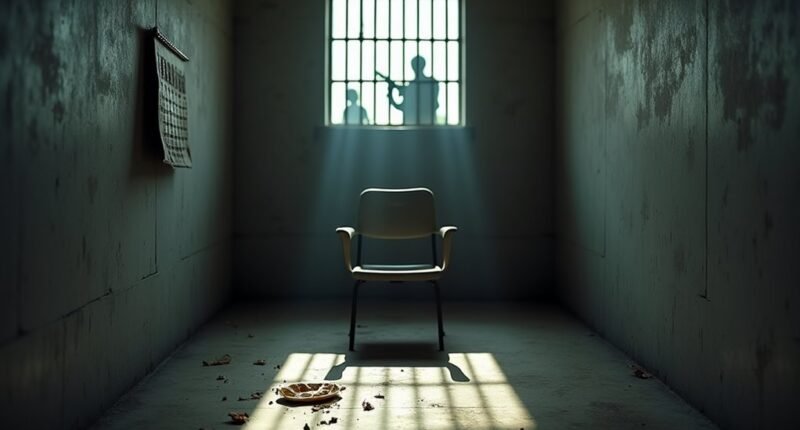

Conditions during the detention were grim. Gambaryan and Anjarwalla faced solitary confinement, malnutrition, and a lack of medical care, all while being guarded by armed personnel. The emotional toll was palpable; it was less a vacation and more a scene from a horror movie. Gambaryan’s health deteriorated, prompting urgent calls for medical intervention, which only added to the drama.

As the world watched, the case garnered international media attention, with Binance CEO Richard Teng rallying for their release. After nearly eight months of uncertainty, pressures from diplomatic channels—think of a global tug-of-war—ultimately led to their release, with charges dropped largely due to Gambaryan’s declining health. This incident underscores the complexities of global regulations that can impact international business operations.

The ripple effects of this event continue to reshape the landscape for international business negotiations, leaving many to wonder: What happens next in this gripping saga?